Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®.

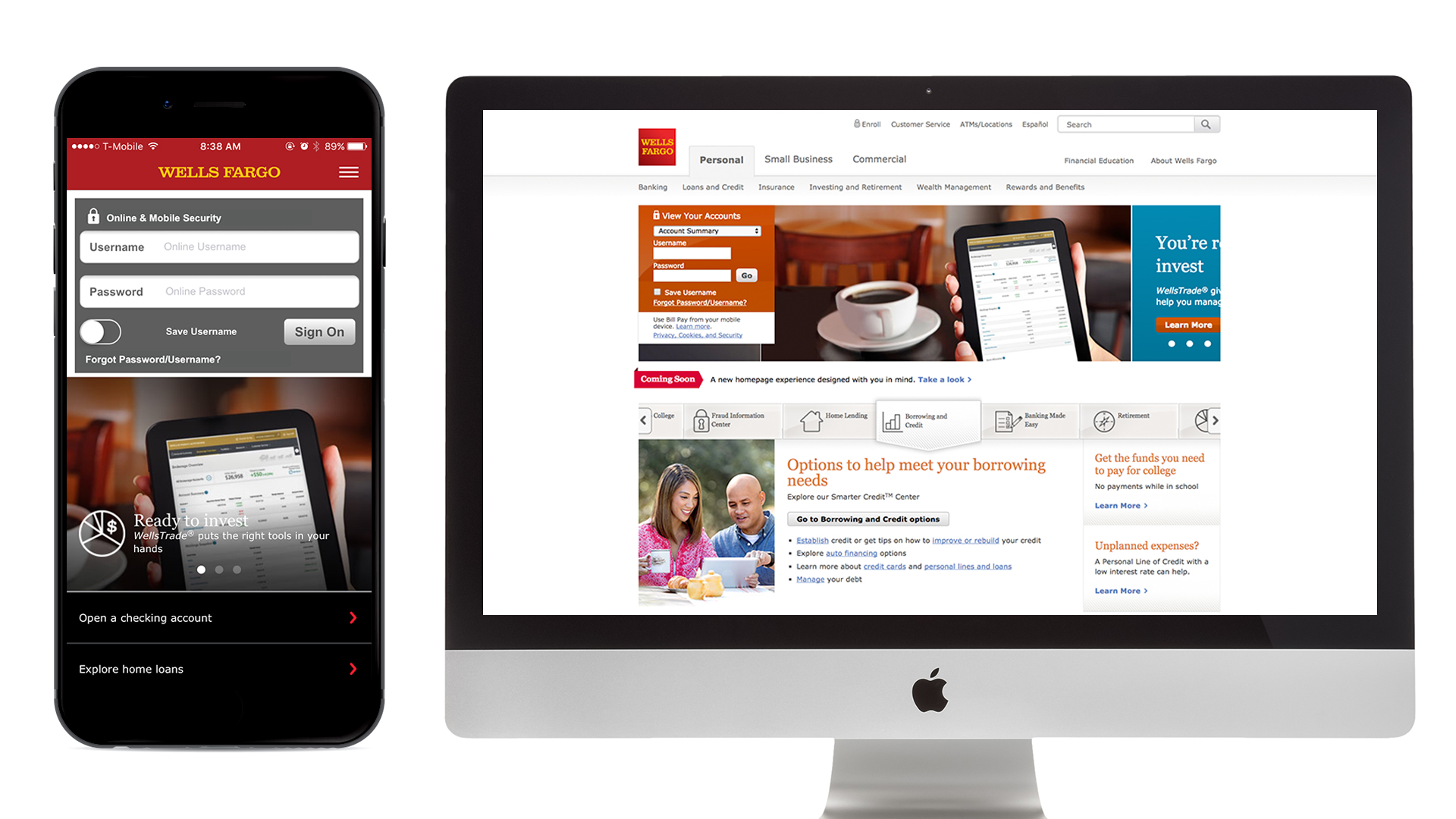

The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. WellsFargoLoginHow to login to your wellsfargo bank online banking in 2020This video tutorial explains the process involved in wells fargo bank online bank.

Refer to an invoice or your welcome package for the customer and contract number. Monthly service overdraft may also apply to your account s that you make Bill Pay payments from. With online banking through Wells Fargo Online you can monitor your balances and activity set up alerts and view statements all from your smartphone tablet or desktop.

Click HERE to pay your Wells Fargo Financial credit card accounts ONLINE. Wells Fargo Online Banking Login How to Access your Account. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account.

The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems.

Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank.

Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made.

Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account.

For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply. Charges may apply however for the Wells Fargo Same Day Payments Service SM. Business Banking and Credit. COVID-19 Information about Paycheck Protection Program Loan ForgivenessLearn more.

Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day. The fee can be avoided if a covering transfer or deposit is made on the same business day.

The other Wells Fargo savings account is Platinum Savings. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period. Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services.

Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank. Other banks have attempted to emulate Wells Fargo's cross-selling practices . Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply.

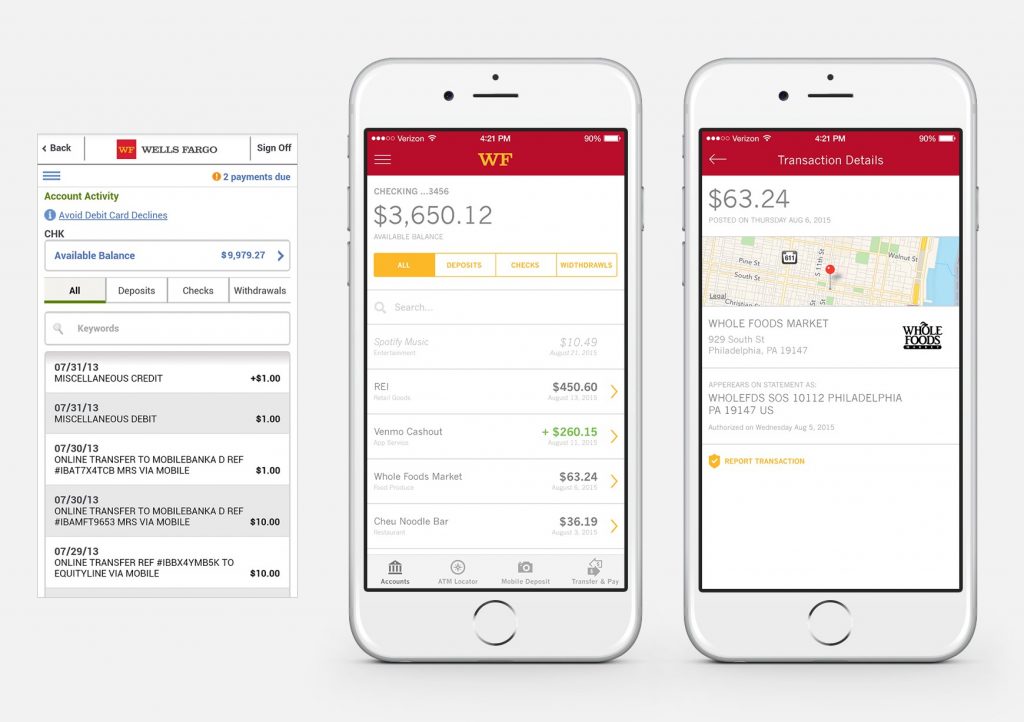

Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations.

Only select Apple devices are eligible to enable Face ID®. If you have family members who look like you, we recommend using your username and password instead of Face ID® to sign on. Wells Fargo internet banking services enable customers manage their bank accounts and find ATMs and bank locations in the state.

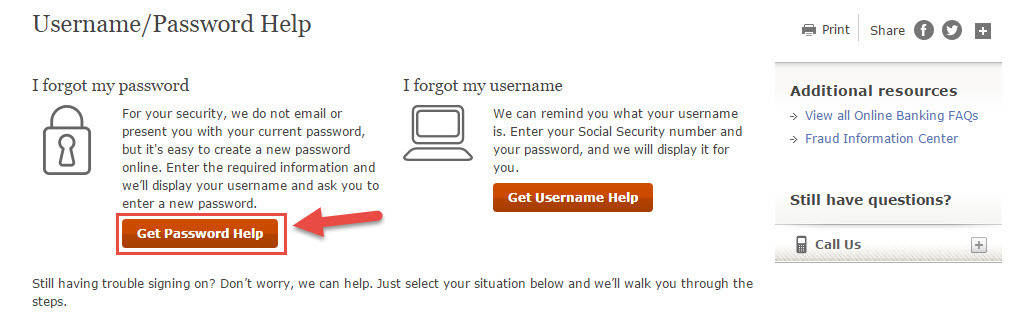

It's free to set up an online account with the bank provided you are a customer with a bank account. The internet banking services are available for both individual and business banking. In this post, you will learn how to login into your online account, how to change your password and how to register for the online services. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24. While it is relatively easy to avoid the monthly fee, make sure you're aware of the other charges you may face, including a $2.50 out-of-network ATM fee and a $35 overdraft fee if you overdraw your account.

If you sign up for Overdraft Protection with a linked savings account, you can avoid the painful $35 fee, but you will still have to pony up a $12.50 transfer fee when the money moves from savings to checking. Only select Android devices are eligible to enable Biometric Sign-On . If you have family members who look like you, we recommend using your username and password instead of Biometric Sign-On to sign on. Overdraft Protection is an optional service you can add to your checking account by linking up to two eligible accounts .

We will use available funds in your linked account to authorize or pay your transactions if you don't have enough money in your checking account. The service is subject to applicable transfer and advance fees. Overdraft Protection is not available for Clear Access Banking℠ accounts. For more information, please refer to the Deposit Account Agreement and Fee and Information Schedule applicable to your account, or visit wellsfargo.com/overdraftservices. Only select devices are eligible to enable sign-on with facial recognition. If you have family members who look like you, we recommend using your username and password instead of facial recognition to sign on.

By texting IPH or AND to 93557, you agree to receive a one-time text message from Wells Fargo with a link to download the Wells Fargo Mobile® app. Please refer to the Supported Browsers and Operating Systems page for mobile OS details. Wells Fargo does not charge a fee to send or receive money with Zelle®. However, when using Zelle® on a mobile device, your mobile carrier's message and data rates may apply.

You can open this account jointly or individually, and you would need to provide some necessary information, driver's license, SSN , and minimum opening deposit. Having your checking account linked to a debit card is possible. Once done, it allows you to access your funds quickly, and you can manage it online. Wells Fargo customers trying Wednesday to find out if their stimulus payments had arrived instead found their mobile app not working and online accounts not accessible. The bank said the outage is due to high volumes and won't affect the electronic deposit of the stimulus money.

Customers looking for a well-established and well-rounded financial institution may do well with Wells Fargo. Not only does this bank possess a large geographic footprint, but it also has every type of account, product and service you may need — a true one-stop banking shop. That said, Wells Fargo has not yet earned back the public's trust after the revelations from 2016 to 2018, of a series of systemic fraudulent practices that victimized its own clients for nearly two decades. Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction. These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option. In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent.

The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package. Capital One also has a 360 Performance Savings Account that boasts a 0.4% APY.

These rates are far higher than what you can earn with any Wells Fargo product, at any balance. If you're willing to give up banking in person, Capital One's bank accounts may present better value than Wells Fargo. If you take the time to waive the paper statement fees by switching to online statements, Wells Fargo's monthly fees are slightly better than those at other major banks.

However, the real advantage at this bank comes with the large variety of options. The Wells Fargo Opportunity Checking Account gives such "toxic" bank customers an opportunity to get back into the mainstream banking system. Availability may be affected by your mobile carrier's coverage area. See Wells Fargo's Online Access Agreementfor other terms, conditions, and limitations.

Wells Fargo Online comes with the ability to receive and view statements for most of your accounts online. Simply enroll to set up a username and password to access your personal and business accounts online. "We know the importance of the stimulus funds to our customers, and Wells Fargo is making the stimulus funds available immediately when they are made available to us," Wells Fargo said in a statement on Tuesday. Wells Fargo offers several other products and services outside of its personal deposit accounts. The bank offers many credit cards, including several popular rewards and cash back credit cards.

Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the bank. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant. Set up is required for transfers to other U.S. financial institutions, and may take 3–5 days. Customers should refer to their other U.S. financial institutions for information about any potential transfer fees charged by those institutions.

See Wells Fargo's Online Access Agreement for more information. Charges may apply, however, for the Wells Fargo Same Day Payments ServiceSM. Please refer to our fees page for fees associated with our online services. Account fees (e.g. monthly service, overdraft) may also apply to your account that you make Bill Pay payments from. Please refer to the Account Agreement, including the Fee and Information Schedule, applicable to your account. You can access Bill Pay for the first time, from either your desktop or mobile device, if you have a Wells Fargo checking account and are enrolled in Wells Fargo Online. If you don't have a Wells Fargo Online username and password, enroll now to get started.

Then, just sign on to Wells Fargo Online to access Bill Pay. The account number is issued once your bank account with Wells Fargo is created. It is a unique ten-digit number that belongs to the account owner. Your account number gives you access to the numerous financial services offered by the bank. This includes funds transfer, withdrawal, making payments, and more. Access to Zelle®, which allows customers to send and receive money with friends, family and others they know and trust who have a U.S.-based bank account, typically in minutes1 directly from one deposit account to another.

Wells Fargo's digital team wasn't content with having made history developing a new way to bank. It wanted to create a place where customers could manage all aspects of their financial lives. Some ideas, like offering horoscopes and used car sales alongside account histories ended quickly with little enthusiasm.

Others, like merging all online accounts into one portal with one log in and mobile banking created meaningful improvements to people's lives. As the bank's premium checking account, Portfolio by Wells Fargo offers customers a number of major perks. At its core, the Portfolio account is an interest-bearing checking account, although the 0.01% APY is not currently impressive. Expect a $25 per month maintenance fee, unless you maintain a minimum of $20,000 in your linked accounts at the end of each statement period. The interest rates at Wells Fargo aren't anything special, but if you're already taking out a loan or using a Wells Fargo checking account, it won't hurt to have a savings account there as well.

With the more basic Way2Save Savings Account and Opportunity Savings, either a $300 daily balance or a $25 automatic transfer from your Wells Fargo checking account will waive the $5 maintenance fee. The real cost of keeping your savings with Wells Fargo is that you'll miss out on stronger rates elsewhere. The outage Wednesday morning occurred on the first official payment date for customers to receive the third round of stimulus checks from the American Rescue Plan. Wells Fargo is an excellent bank for those looking for both local branch access and digital banking services. The bank's interest rates on most of its accounts leave a lot to be desired compared to the best online banks, but they are comparable to other national banks.